We now have a relationship with a Wyoming NFA Gun Trust Lawyer® who can provide NFA Trusts for Wyoming residents. If you live in Cheyenne, Laramie, Sheridan, Casper, Rawlins, Buffalo, Gillette, Evanston, Riverton, Cody, Jackson Hole or anywhere in Wyoming, contact a Gun Trust Lawyer® to find out more about a Wyoming Gun Trust.

We now have a relationship with a Wyoming NFA Gun Trust Lawyer® who can provide NFA Trusts for Wyoming residents. If you live in Cheyenne, Laramie, Sheridan, Casper, Rawlins, Buffalo, Gillette, Evanston, Riverton, Cody, Jackson Hole or anywhere in Wyoming, contact a Gun Trust Lawyer® to find out more about a Wyoming Gun Trust.

Have NFA Gun Trusts or Revocable Living Trusts Been Successfully Challenged by ATF?

We often get questions regarding the use of NFA Trusts in regards to legal challenges to show that they are permitted under the NFA.

While there are no successful challenges that stand for the positive or negative use of a NFA Trust, Trusts are not generally denied because the Federal statutes specifically authorizes the use of a trust for ownership of a item restricted by the NFA. There have been many applications with the ATF by people using other forms of Trusts that have been denied because the application or the trust was improper.

The more troubling issue with a Trust is that there are many invalid trusts that have been approved by the ATF. The reason this is problematic is that many individuals feel there possession and use of these firearms valid because ATF approved the transfer. They do not realize that the ATF’s approval is to a valid trust and while they may disapprove an obviously invalid trust, there is no requirement for the ATF to validate (nor do they validate) a trust.

Obama Picks a Director For the A.T.F.

The New York Times is reporting that Nearly two years into his term, President Obama on Monday finally chose a director for the Bureau of Alcohol, Tobacco, Firearms and Explosives. Mr. Obama will submit the name of Andrew Taver, the special agent in charge of the bureau’s Chicago field division, to the Senate for consideration.

The New York Times is reporting that Nearly two years into his term, President Obama on Monday finally chose a director for the Bureau of Alcohol, Tobacco, Firearms and Explosives. Mr. Obama will submit the name of Andrew Taver, the special agent in charge of the bureau’s Chicago field division, to the Senate for consideration.

Mr. Taver may face a confirmation fight as it will require Senate confirmation.

Brandishing a Silencer?

How many of you have taken your silencer out to show to someone. Did you know that even if it is not attached to a gun, a silencer is defined by federal law as a firearm. Many states also define it as a dangerous weapon like a taser or a knife.

In Florida and many states that have concealed weapons permits, it is illegal to show someone a firearm or weapon under certain circumstances. With this in mind, you should be careful to comply with your states concealed weapons laws when showing people your silencer. Many people do not realize they are legal and because of this it is possible that you could be reported for having one and charged with a crime.

While we know of know one who has actually been charged with this offense and feel that the likelihood is small, it does not make the act legal and you should be cautious.

How Long Should My ATF Form 4 or Form 1 Approval Take

Generally we are hearing that it is taking 3-5 months from the time you submit your ATF forms for approval. A local gun store Shooters of Jacksonville told me they have two agents assigned because of the number of transfers they do. They stated that this means that ATF Form 4 applications that they sent in are processed faster than at other locations. While I do not know if this is true, I can state, that a recent Form 4 I submitted through Shooters only took 75 days from the date I signed it, until receiving the approved Form 4.

If you want to check on the status of your Form 4 or Form 1, you will need your serial number and to contact ATF.

National Firearms Act Branch,

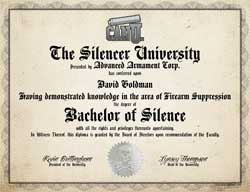

Silencer University – Yes Silencers are legal!

Think you know all about silencers? You may be surprised to see what you don’t know about them. Check out Advanced Armament Corporations Can U – The Silencer University.

Think you know all about silencers? You may be surprised to see what you don’t know about them. Check out Advanced Armament Corporations Can U – The Silencer University.

When you pass the test, they will send you a membership card and discounts on products.

Silencer’s on an airplane and being detained by TSA

Last week, I got an email and spoke to an individual (who was an attorney) who had been incorrectly advised by TSA that it was OK to carry a silencer on a plane. The problem occurred when he tried to follow TSA’s advise. A silencer is defined as a firearm and should not be taken in one’s carry on luggage. Luckily this individual was not charged with a crime and only ended up being inconvenienced and missing his flight.

Last week, I got an email and spoke to an individual (who was an attorney) who had been incorrectly advised by TSA that it was OK to carry a silencer on a plane. The problem occurred when he tried to follow TSA’s advise. A silencer is defined as a firearm and should not be taken in one’s carry on luggage. Luckily this individual was not charged with a crime and only ended up being inconvenienced and missing his flight.

After contacting the FBI, BATFE, and Dallas police (none of whom had a definitive answer) the Dallas police and DFW police said the suppressor should be turned over to TSA who eventually returned it to the owner.

Others have reported that TSA does not understand that Silencers are firearms and have not allowed them to put them in locked containers as other firearms.

ATF = Inconsistency- to assign or not to assign

Lately we have seen such odd denials from the ATF.

- A self created trust was denied because it did not contain an assignment sheet

- A trust was denied because it did contain an assignment sheet.

Alaska Class 3 Dealers

We have also run across a list of some Alaska Class 3 dealers.

Arctic Arms 907-770-7502 Arctic Custom Services 907-376-0703 Arms and Equipment 907-479-4867 B&B Firearms 907-333-9461 R&M Sporting Goods 907-357-9711

If you are a Class 3 dealer or know of other Alaska Class 3 dealers let us know.

Alaska Machine Gun Shoot

This years annual machine gun shoot was May 29-30 at Riverside Park Campground and Range in Anderson AK. The Alaska machine Gun Association’s website gives information on their machine gun shoots.

If you have checked on an Alaska NFA Gun Trust in the past and were unhappy about the price, we have some good news. We have a new attorney that we are working with ( not new to the practice of law, but new to our network) and he is offering some very competitive prices on the NFA trust ( as much as 1/2 off the previous lawyers pricing). If you are interested in an Alaska Gun Trust Contact Us to find out more and begin the process.